CASE STUDY

Boosting Customer Acquisition & Retention with Experiture’s Finance Marketing Solutions

How One Financial Institution Increased Customer Engagement and Improved Loan Applications Through Omni-Channel Campaigns

This case study explores how Experiture helped a financial institution grow its customer base, enhance customer loyalty, and increase loan applications through personalized, cross-channel marketing strategies.

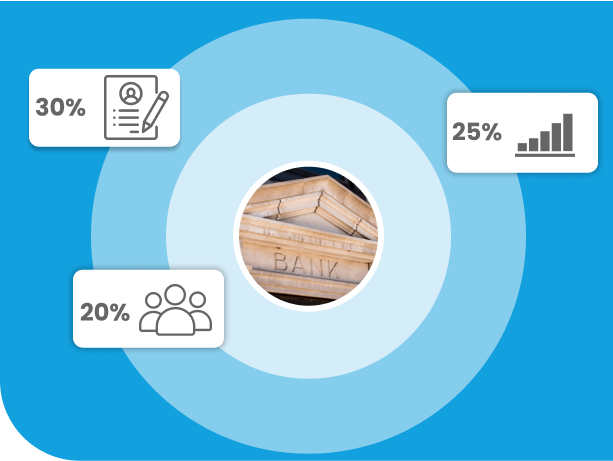

Results That Speak for Themselves (Metrics):

See the measurable outcomes achieved through tailored financial marketing:

in loan applications driven by personalized offers

in customer retention through targeted outreach

in new customer acquisitions via automated campaigns

Strategic Moves That Drove Success

Personalized Loan Offers:

Using customer data to deliver relevant loan offers based on financial behavior and preferences.

Cross-Channel Communication:

Ensuring consistent messaging across email, SMS, direct mail, and personalized customer portals to engage customers at every touchpoint.

Automated Financial Workflows:

Streamlining customer communication with automated workflows for loan follow-ups, financial product recommendations, and re-engagement offers

Uncover the Full Playbook

Let’s discuss how these strategies can transform your engagement. Schedule a consultation to see how Experiture can work for your institution.

Challenge

The financial institution faced difficulties in retaining customers and increasing loan applications. Fragmented communication and lack of personalization led to missed opportunities in attracting new clients and building long-term relationships.

Solution

Experiture partnered with the financial institution to create a personalized, Omni-Channel marketing strategy designed to improve customer acquisition and retention while boosting loan applications.

Key strategies included:

- Personalized Loan Offers: By integrating customer financial data with Experiture’s platform, the institution was able to create personalized loan offers and product recommendations tailored to each customer’s financial needs and history.

- Omni-Channel Communication: Email, SMS, direct mail, and personalized customer portals were used to deliver consistent and relevant messaging, ensuring customers were always engaged with appropriate financial products

- Automated Loan Application Workflows: Automated workflows managed key touchpoints, such as loan follow-up messages, financial product reminders, and re-engagement offers, allowing the institution to nurture customer relationships and increase conversions.

Results

The financial institution achieved significant improvements after implementing Experiture’s marketing solutions.

- 30% increase in loan applications, driven by personalized offers that resonated with customers.

- 25% boost in customer retention, thanks to targeted outreach that kept clients engaged with the institution’s services.

- 20% growth in new customer acquisitions, as automated campaigns effectively attracted and converted new leads.

These results demonstrate the value of personalized, data-driven marketing in the financial sector. By delivering the right message to the right customer at the right time, the institution saw improvements in both customer retention and acquisition.